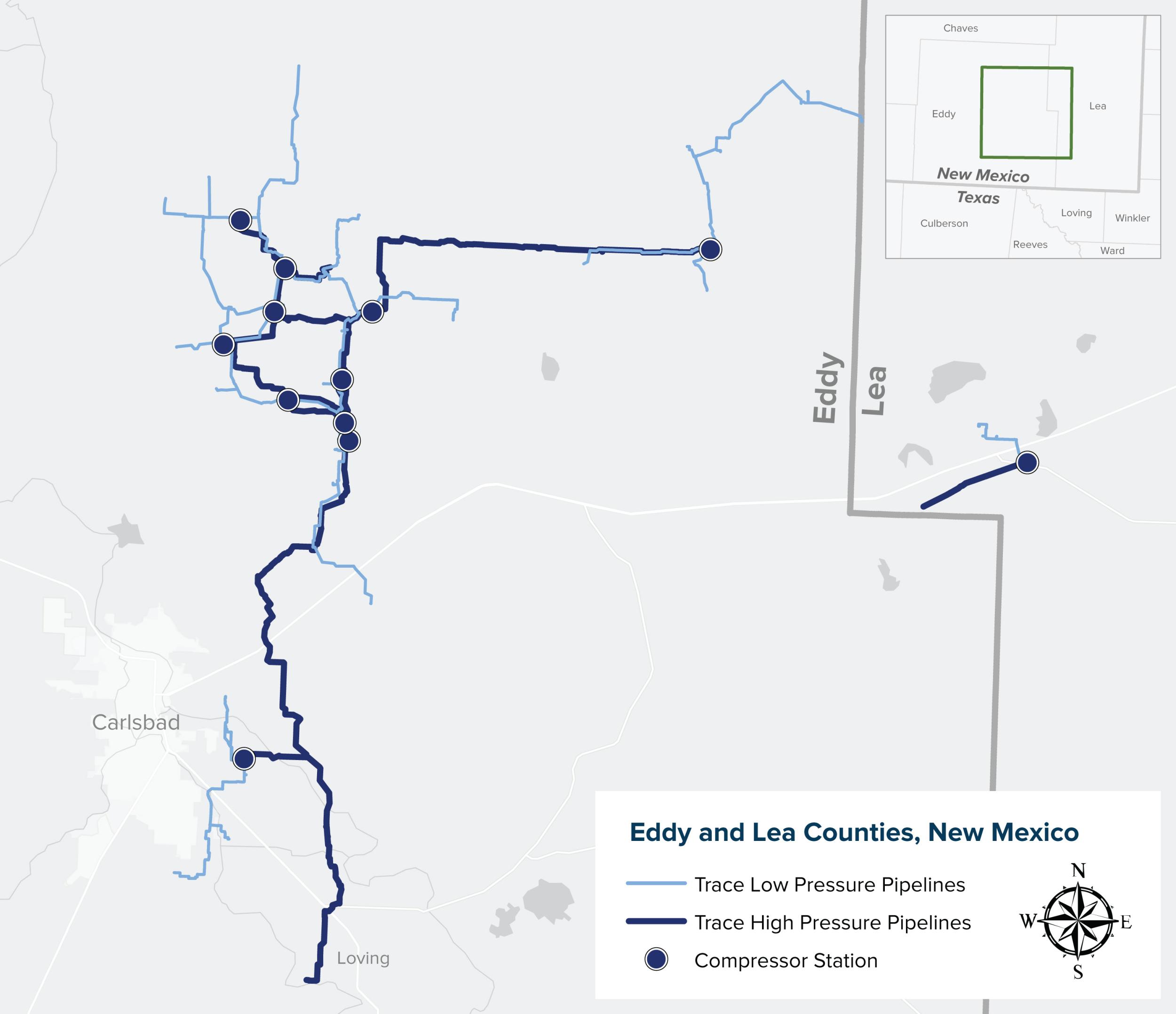

Northern Delaware Basin Gathering

Trace Midstream operates best-in-class natural gas gathering and transportation assets in the Northern Delaware Basin. Located in Eddy and Lea counties in New Mexico, Trace Midstream’s natural gas gathering and transportation system consists of high- and low-pressure gas pipelines with associated compression, dehydration, condensate handling, and vapor recovery capabilities. Upon completion of current growth projects, the system will consist of approximately 180 miles of pipeline and 12 compressor stations, with a total design capacity of 650 million cubic feet per day and is supported by over 85,000 dedicated acres.

With a strong focus on customer service, safety, and operational excellence, Trace Midstream provides producers with custom midstream options, executing each project in a timely and cost-efficient manner.